Best Construction Loan Lenders

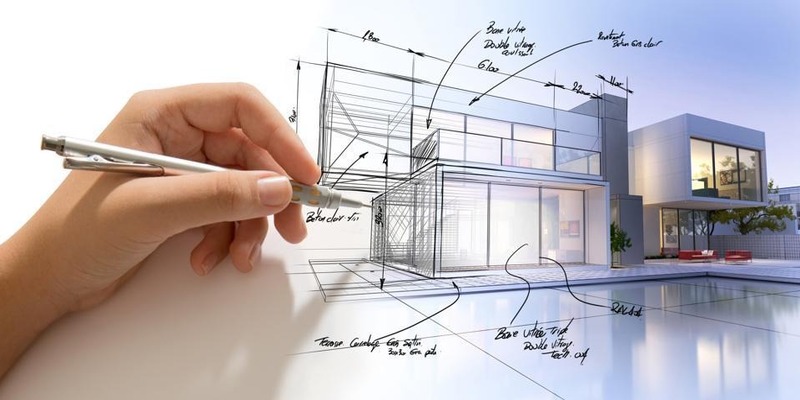

Financing the construction of a new house typically requires a short-term loan, such as a construction loan, which can be obtained by either the borrower or the builder.

Whether you're doing some DIY building on your existing home, commissioning a contractor to create a new one on some property you've purchased, or doing a complete renovation, a construction loan might be useful.

The amount of permits for new homes being built suggests that this trend will continue for the foreseeable future. About 1.47 million new homes will be constructed by 2020. 1 There will be demand for construction loan lenders to finance all the new buildings.

BuildBuyRefi

Magnolia Bank's BuildBuyRefi department was once known as the Nationwide Home Loans Group. The employees' cumulative years of experience at the organization exceed 100.

The fact that BuildBuyRefi can finance the land, the building, and a permanent mortgage into a single rate-locked loan made them our top choice for a construction loan lender. Advantages include paying only once for closing fees and locking in an interest rate that won't change even if rates rise during construction.

TD Bank

With more than nine million clients and 1,250 facilities along the East Coast, TD Bank is one of the top 10 largest banks in the United States. Private banking services, mortgages, refinancing, building loans, equity lines, and unsecured personal loans are all available.

Because of its flexible loan terms, numerous branch locations for client convenience, and various loan packages with minimal down payments, TD Bank is our runner-up pick for top overall construction loan lenders.

FMC Lending

FMC Lending was founded not too long ago and operated out of California. As a private lender, it provides individualized finance for equity-based projects.

The company also provides lending options for borrowers with less-than-perfect credit or no income documentation. You might consider FMC Lending if you have a poor credit score, are self-employed, or have a changing income.

We recommend FMC Lending to anybody in need of a construction loan, regardless of their credit history, since they do not require a high credit score to get approved, they deal with borrowers who would not qualify for traditional funding, and they have no set loan minimums.

Wells Fargo

Wells Fargo is an iconic financial organization that has been around since the 1850s. The San Francisco-based company has developed to provide a wide range of financial products and services, such as mortgages, construction loans, loans to small businesses, consumer loans, and financial investments.

Since first-time borrowers typically have many questions when applying for a construction loan, we found that Wells Fargo was the best lender to work with. You may reach them through phone, email, or their website.

What Is the Definition of a Construction Loan?

Financing the construction of a new house typically requires a short-term loan, such as a construction loan, which can be obtained by either the borrower or the builder. A second house or investment property is typically not eligible.

Except in the case of a commercial loan, a construction loan cannot be utilized on a property that will not be used as a primary residence. Standard construction loans have a one-year term and then convert to a permanent loans.

Who Needs a Building Loan, and Why?

A construction loan can be useful whether you're doing major renovations to your present residence, intending to construct a new home on newly acquired land, or doing any of the above.

In most cases, there are better choices than a construction loan for repairs or upgrades to an existing building. A home equity loan or line of credit is the more cost-effective option.

It's not a good idea to take out a construction loan if you can't afford to wait around for the project to finish if it takes longer than intended to build. Also, the weather and the availability of materials and supplies are two external factors that might drive up prices.

What Sets Construction Loans Apart From Home Improvement Financing?

A construction loan is used to finance the construction of a building, whereas an improvement loan is used to finance the upkeep or repair of an existing structure.

Construction loans are riskier for lenders than renovation loans since there is no guarantee that the project will be completed on time and within budget. So, the requirements for a construction loan are more stringent than those for a home repair loan.