Things You Need To Understand About Eurobonds

Eurobonds are a type of bond issued in a currency other than the domestic currency of the country or market. Eurobonds can be broken down into subcategories based on the currency in which securities are denominated. Often referred to as "external bonds," this name comes from Eurobonds being denominated in a foreign currency. Eurobonds are helpful because they allow companies to issue debt in a currency other than their home countries without converting their existing cash reserves. In the case of Eurobonds, the issuance process is often managed on the borrower's behalf by someone with a multinational syndicate comprising financial institutions, one of whom might underwrite the bond, consequently guaranteeing the purchase of the whole issue.

How Eurobonds Work

Take the hypothetical case of a U.S. company's interest in entering the Indian market. They need to get funding to construct several stores before they can accomplish it. The Indian rupee will be used to pay for the construction of these areas, although the company is unlikely to have a credit history in India. A bond denominated in Indian rupees may be issued by the company in the United States then. Loan rates for the firm have dropped. The United States also benefits from a diversified portfolio. Due to the growth of international trade, these Eurobonds have gained popularity. Capitalized Eurobonds are not the same thing as Eurobonds. The former describes a request for bids on bonds issued jointly by nations inside the Eurozone. Two of the Eurozone's weaker members, Italy and Spain, would benefit from the cheaper borrowing rates made possible by jointly issued Eurobonds.

Eurobonds Are Issued By Whoever Issues Them

Eurobonds are an excellent option for private companies, multinational syndicates, and even governments requiring limited foreign currency access. The interest rate on Eurobonds is typically set, even if the bonds are issued for very long terms.

What Is The History Of Eurobonds?

In 1963, Autostrade, the Italian state railroad business, issued the first Eurobond. London-based bankers conceptualized the bond's $15 million face value, printed it at Schiphol Airport in Amsterdam, and finally cashed it in Luxembourg. It gave Europeans a chance to invest in something stable that was denominated in dollars. There is a wide range of potential issuers, from private companies and governments to international organizations. Bonds can be issued with maturities ranging from five to thirty years, with the majority having a duration of fewer than ten years. Issuance sizes can exceed a billion dollars. Issuers in countries without a sizable capital market will find Eurobonds particularly appealing because of the diversification they provide to investors.

Delivery

There was a period when investors in Eurobonds received paper copies in the mail. Electronic services such as the Depository Trust Company (DTC) in the United States and the Certificateless Registry of Electronic Share Transfer (CREST) throughout the United Kingdom are used to issue these shares. The bearer form in which Eurobonds are often given makes it simpler for investors to evade taxation and other forms of government oversight. A bond in bearer form has not been registered in a specific person's name and hence does not have a public record of who owns it. Instead, ownership of a bond can only be established by physically possessing it.

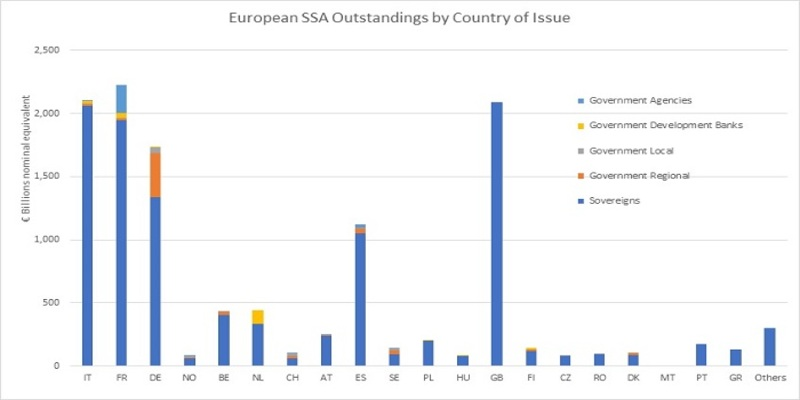

Market Size

There are currently bonds with a face value of over $100 trillion on the world's bond markets. Since many Eurobonds still need to be registered and are traded in bearer form, it is challenging to gather complete statistics on the sector; despite this, it is estimated that these Eurobonds account for somewhere in the area of 30% of the total. There has been a rise in the number of Eurobonds released from emerging market nations as their governments and corporations seek out more profound and developed markets to borrow money. This growth is because countries with rising economies have perpetually sought out those with more mature consumer markets.

Conclusion

Eurobonds are bonds issued in a country in a currency other than the country's official currency. With a term of 5-30 years, it is a fixed-income debt instrument as well as an asset traded on the euro currency market. These bonds have lower interest rates and no exposure to foreign exchange risk. Consequently, this facilitates raising funds in the target currency for international business expansion. Euro refers to the bond's denominated foreign currency. Therefore, it is sometimes called an external bond or a bond denominated in a foreign currency. A bond denominated in euro and issued in Japanese yen is an example of a Euroyen bond.