What You Should Know About The Business Valuation Approach For Investors

Determining a company's worth is called a business valuation. The value of a company and its constituent parts, or "units," are determined by a comprehensive examination of all aspects of the company. An correct valuation of a firm is necessary in a wide variety of legal and financial contexts, such as during the purchase or sale of a share, the distribution of assets, or the resolution of a divorce. Many business owners consult with experienced business assessors to get an unbiased evaluation of their capital.

What Is the Valuation of a Business?

When a company's worth is calculated, the process is called a valuation. The primary objective of every company is to increase the wealth of its owners or shareholders. While the timelines, approaches, and outcomes may vary, the purpose remains constant. Valuations of businesses are always approximations. Who does the study and what is being valued significantly impact the final product? When determining a company's worth for an IPO, investment bankers will argue for the highest possible valuation, while accountants will go for the lowest possible valuation for tax considerations. Pricing and valuation are two distinct concepts. The value of a company can only be determined by looking at how well it has done in the past. The interplay between supply and demand determines prices.

The Fundamentals of Business Valuation

In corporate finance, business valuation is a topic of regular conversation. If your firm is considering selling all or part of its operations, mergers, or acquisitions, you will likely want to do a business valuation. Business valuation is the process of estimating a company's value in the present by considering all relevant factors and utilizing objective metrics.

Methods of Valuation

A company's worth may be determined in a variety of ways. Several of these techniques will be discussed in further detail below.

Capitalization of the Market

Values may be estimated using a variety of metrics, but the quickest and easiest is market capitalization. The market capitalization of a corporation is the current stock price multiplied by the total number of outstanding shares. As an illustration, Microsoft Inc. shares were trading at $86.35 on January 3, 2018. If there are a total of 7.715 billion shares in circulation, multiplying $86.35 by that amount yields $666.19 billion as a possible valuation for the corporation.

Method of Times Revenue

The Times revenue technique estimates a company's value by multiplying its expected future cash flows by a factor that varies by sector and economy. As an illustration, a technology business may be valued at three times its annual sales, whereas a service company would be valued at half that amount.

Earnings Multiplier

Profits are a more reliable indicator of a company's financial health than sales revenue, thus an earnings multiplier may be employed instead of the time-honored revenue method to provide a clearer picture of a company's genuine value. If you want to see how your expected profits stack up against what you might make by investing the same amount of cash at the current interest rate, you may use a tool called the earnings multiplier. When figuring up the price-to-earnings ratio, it factors in the going interest rate.

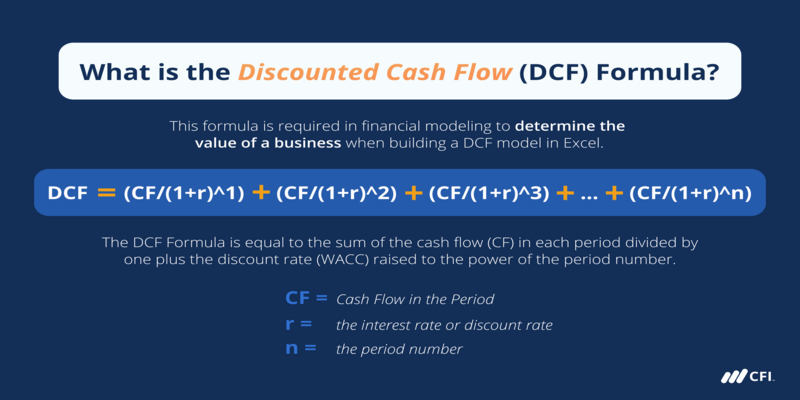

Method of Discounted Cash Flow (DCF)

DCF, or the discounted cash flow approach, is used to value businesses in a way comparable to the earnings multiplier. The company's current market value is calculated using this approach by adjusting forecasts of future cash flows. The discounted cash flow approach is an alternative to the profit multiplier in which inflation is included in the present value calculation.

Book Value

According to the financial statement, this is how much a company's stockholders are now invested in the company. One way to calculate a company's book value is to take its total assets and remove its liabilities.

Liquidation Value

The liquidation value of a company is the sum of money that might be obtained by selling all of its assets and paying off all of its debts at once. Please note that this is by no means an all-inclusive list of the many approaches now used to assess the worth of a company. The terms "replacement value," "breakup value," and "asset-based valuation" are only a few of the numerous alternative approaches.

Conclusion

A business valuation aims to provide business owners with a realistic and independent assessment of their company's worth by calculating its economic value. Companies are valued when their owners want to sell all or part of the company and combine with another firm. To develop your firm, you may require loans or equity, a more in-depth tax examination, or more shareholders. In this last scenario, it is also essential to calculate the worth of the stock. A company's current price is determined by a thorough analysis of the firm's management, capital structure, future profits, and market value of its assets, among other factors, and the results are reported to the company's owner.